The weight of student loan debt hangs heavy on the shoulders of millions of Americans. According to the Federal Reserve, total student loan debt in the United States is over $1.7 trillion, with the average borrower owing around $30,000 in student loans. While federal student loans offer generous repayment programs and forgiveness options, private student loans often lack such safeguards. This can leave borrowers facing a confusing maze of interest rates, loan terms, and repayment options. Luckily, private student loan debt consolidation can be a powerful tool to simplify your debt and potentially lower your monthly payments. This in-depth guide will equip you with the knowledge to navigate the complexities of private student loan consolidation, unraveling the process, understanding its advantages and disadvantages, and empowering you with the tools to make informed decisions about your financial future.

Overview of Private Student Loan Debt Consolidation

Private student loan debt consolidation involves taking out a new loan to pay off multiple existing private loans. The new loan usually comes with a lower interest rate, making it easier for borrowers to manage their debt and potentially save thousands of dollars over the life of the loan. It combines all of your individual loans into one, simplifying the repayment process by only having to make one monthly payment instead of multiple payments to different lenders. This not only makes it easier to keep track of payments but can also help improve credit scores by showing a more consistent payment history.

The Process of Consolidating Private Student Loans

Consolidating private student loans involves several steps, including researching and selecting the right lender, applying for the new loan, and then using the funds to pay off your existing loans. The first step is to research and compare different lenders to find the best interest rates and terms for your specific financial situation. Once you have selected a lender, you will need to fill out an application and provide information about your current loans, such as the lender, remaining balance, and interest rate. If approved, the new loan will be used to pay off your existing loans, and you will then make payments on the new loan until it is fully repaid.

The Role of Credit Scores in Private Student Loan Consolidation

Your credit score plays a crucial role in the consolidation process, as it can determine your eligibility for a new loan and the interest rate you may receive. Typically, borrowers with higher credit scores are more likely to be approved for consolidation loans with lower interest rates. It’s essential to know your credit score and take steps to improve it, if needed, before applying for a consolidation loan.

Potential Risks of Consolidating Private Student Loans

As with any financial decision, there are potential risks to consider when consolidating private student loans. One risk is that you may lose certain benefits or protections that were offered by your original loans, such as deferment options or forgiveness programs. Additionally, if you extend the repayment period through consolidation, you may end up paying more in interest over time. It’s important to carefully weigh the pros and cons before deciding if consolidation is the right choice for you.

Benefits of Consolidating Private Student Loans

Consolidating private student loans offers numerous benefits for borrowers, making it a popular option for those looking to simplify their debt and potentially save money. Here are some of the key advantages of private student loan debt consolidation:

Lower Interest Rates

One of the primary reasons borrowers choose to consolidate their private student loans is to secure a lower interest rate. Private loans often come with higher interest rates compared to federal loans, making them more expensive to repay over time. By consolidating, borrowers may be able to secure a lower interest rate, which can save them thousands of dollars over the life of the loan.

Simplified Repayment

Managing multiple loans from different lenders can be confusing and overwhelming. Consolidating private student loans streamlines the repayment process by combining all of your loans into one, making it easier to manage and keep track of payments.

Potentially Lower Monthly Payments

In addition to securing a lower interest rate, consolidating private student loans can also lead to lower monthly payments. By extending the repayment period, borrowers may see a decrease in their monthly payment amount, making it more manageable for their budget.

Fixed Interest Rates

Private student loans often come with variable interest rates, which means they can fluctuate over time. By consolidating, you can secure a fixed interest rate, providing stability and predictability in your monthly payments.

Key Factors to Consider Before Consolidation

Before deciding to consolidate your private student loans, it’s essential to consider several factors that could impact your decision and overall financial situation. Here are some key factors to keep in mind:

Current Interest Rates

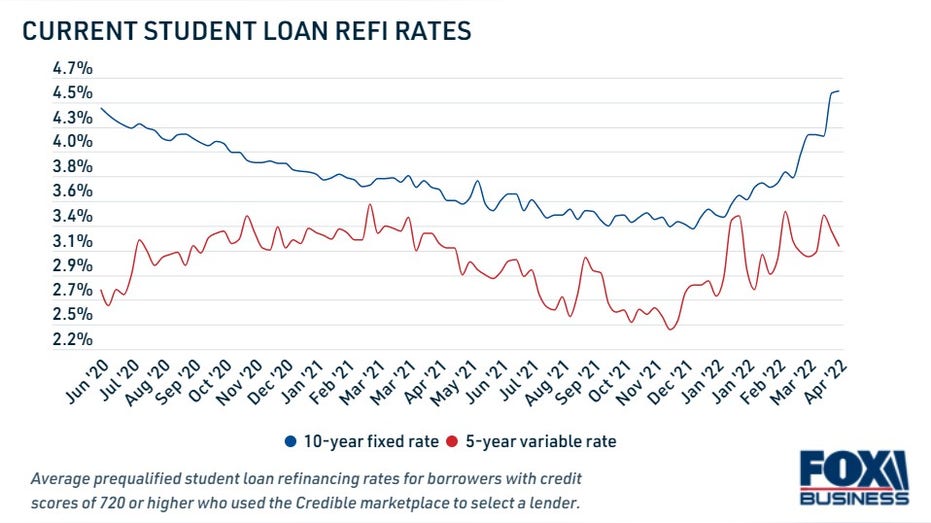

Before consolidating, research the current interest rates offered by different lenders to ensure that you will be getting a better rate than what you currently have. It’s also important to compare the rates of fixed and variable interest loans to determine which option is best for you.

Fees and Costs

Consolidating private student loans may come with fees and costs, such as origination fees or prepayment penalties. It’s essential to carefully review all fees associated with the consolidation loan to determine if the potential savings in interest outweigh these costs.

Impact on Credit Score

As mentioned earlier, your credit score plays a crucial role in the consolidation process. When you apply for a new loan, it results in a hard inquiry on your credit report, which can temporarily lower your credit score. However, once the loan is approved and paid off, it can also positively impact your credit score by showing a consistent payment history.

Potential Loss of Benefits

Before consolidating, make sure to thoroughly review the terms and benefits of your current loans to determine if any will be lost through consolidation. For example, if you have a private loan with a co-signer, they may also lose their protection if the loan is consolidated.

Top Lenders and Their Consolidation Programs

When it comes to consolidating private student loans, there are numerous lenders to choose from, each with their own consolidation programs and terms. Here are some of the top lenders and an overview of their consolidation options:

SoFi

SoFi offers both fixed and variable interest rate consolidation loans with repayment terms of five, seven, ten, or fifteen years. They do not charge any fees or prepayment penalties and offer additional benefits such as job loss protection and career coaching for borrowers.

Earnest

Earnest offers fixed and variable interest rate consolidation loans with repayment terms ranging from five to twenty years. They also do not charge any fees or prepayment penalties and offer options for co-signers to be released from the loan after a certain number of on-time payments.

Citizens Bank

Citizens Bank offers both fixed and variable interest rate consolidation loans with repayment terms ranging from five to fifteen years. They also do not charge any fees or prepayment penalties and offer additional benefits such as interest rate discounts for automatic payments.

Discover

Discover offers fixed interest rate consolidation loans with repayment terms ranging from ten to twenty years. They do not charge any fees or prepayment penalties and offer additional benefits such as interest rate discounts for autopay.

Wells Fargo

Wells Fargo offers both fixed and variable interest rate consolidation loans with repayment terms ranging from fifteen to twenty years. They do not charge any fees or prepayment penalties but do not offer many additional benefits compared to other lenders.

It’s crucial to thoroughly research and compare different lenders to find the best consolidation option for your specific financial situation.

Expert Tips for Successful Loan Consolidation

Consolidating private student loans can be a beneficial financial strategy for many borrowers, but it’s essential to approach it carefully and thoughtfully. Here are some expert tips for successful loan consolidation:

Understand Your Existing Loans

Before applying for consolidation, make sure you understand the terms and benefits of your existing loans. This will help you determine if consolidation makes sense for your situation and ensure that you don’t lose any valuable benefits through the process.

Have a Good Credit Score

Having a good credit score can significantly impact your interest rate and eligibility for loan consolidation. Before applying, take steps to improve your credit score, such as paying off credit card debt or making all payments on time.

Compare Interest Rates and Fees

As mentioned earlier, it’s crucial to compare interest rates and fees from different lenders to find the best consolidation option for you. Don’t just look at the interest rates; consider any fees or penalties that may impact the overall cost of the loan.

Consider Co-Signers

If you have a co-signer on your existing loans, make sure to discuss consolidation with them as well. They may also benefit from the lower interest rate, and some lenders offer options for co-signers to be released from the loan after a certain number of on-time payments.

Stay Organized

Consolidating private student loans involves dealing with multiple loans and lenders, so it’s essential to stay organized throughout the process. Keep track of all communication and paperwork to avoid any confusion or potential issues.

Conclusion

Private student loan debt consolidation can be a valuable tool for simplifying your debt and potentially saving money on interest over time. By understanding the process, weighing the pros and cons, and considering key factors, you can make informed decisions about consolidating your private student loans. Remember to carefully research and compare lenders to find the best consolidation option for your specific financial situation. With some patience and organization, you can successfully navigate the labyrinth of private student loan consolidation and take control of your financial future.